Corporate Payment Service Provider

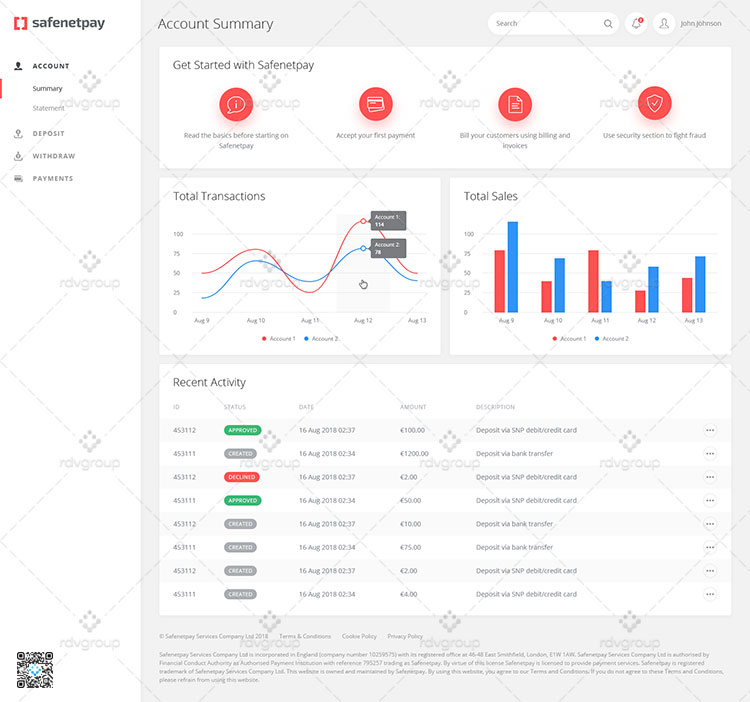

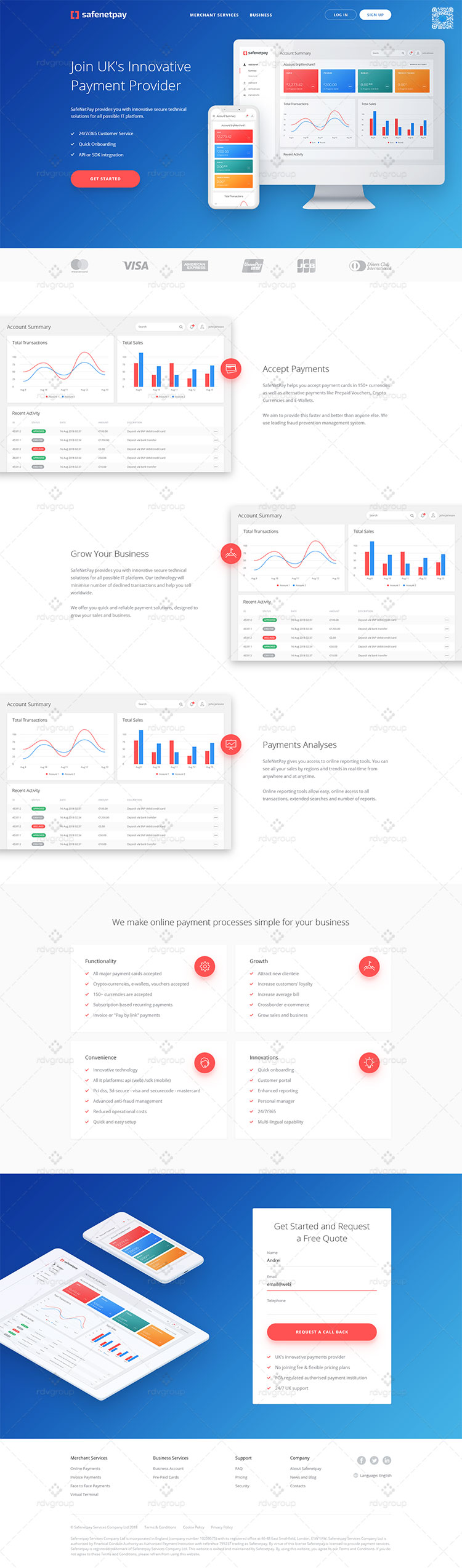

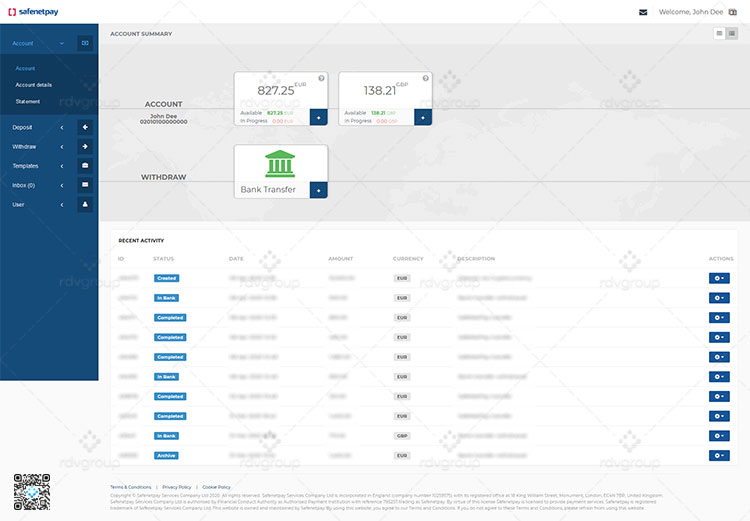

A serious task stood before our team – production of an E-Wallet solution. For this, a system, based on Payment Processing Platform, capable of providing the highest level of functionality of payment services, was developed. The system, infrastructure and business processes were developed in accordance to the RTS, MFSA, PCI-DSS, GDPR standards.

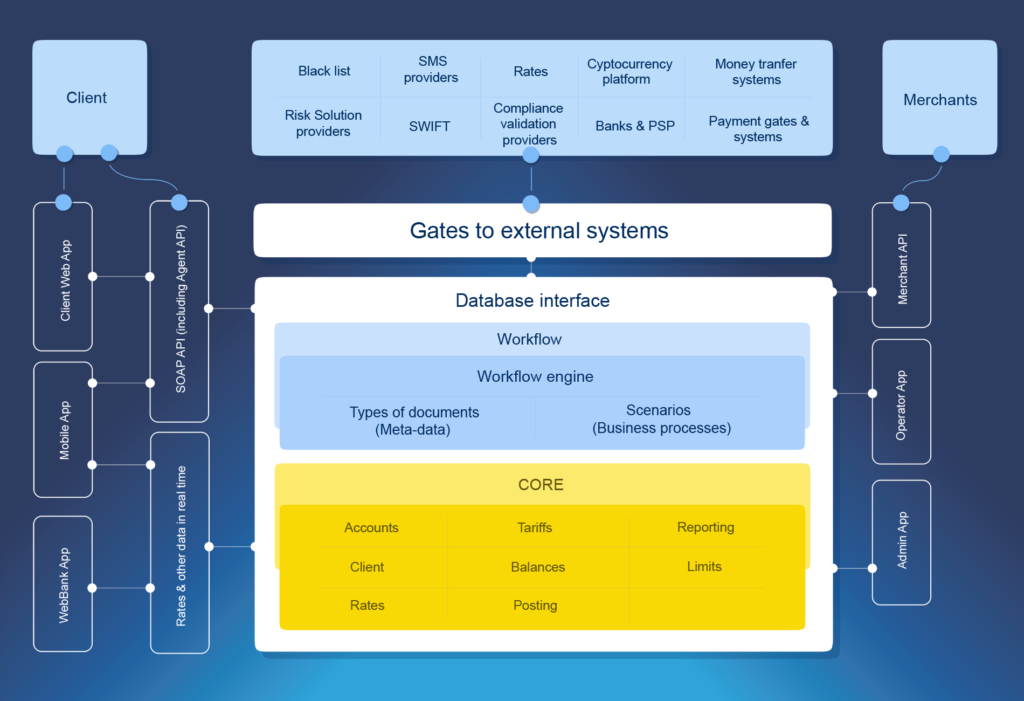

System architecture:

Implemented functional requirements:

- Client registration

- AML/KYC checks using an integrated service

- Automatic document identification, authenticity check using an integrated service and manual confirmation

- Client profile creation

- Account creation and IBAN assignment

- Payments

- Internal transfers between internal accounts

- Transfers inside the system

- Recurring payments

- Bank payments (SWIFT/SEPA)

- Cryptocurrency operations

- Remittance

- Transfers without opening an account

- Via external money transfer systems

- Payment instrument acquisition

- Internet-acquiring

- Virtual instruments

- Issue of virtual gift cards

- Withdrawal from account

- Bank transfers (SWIFT/SEPA)

- Money transfer systems

- E-Wallets

- Virtual cards

- Deposit to account

- Bank transfers (SWIFT/SEPA)

- Money transfer systems

- E-Wallets

- Virtual cards and vouchers

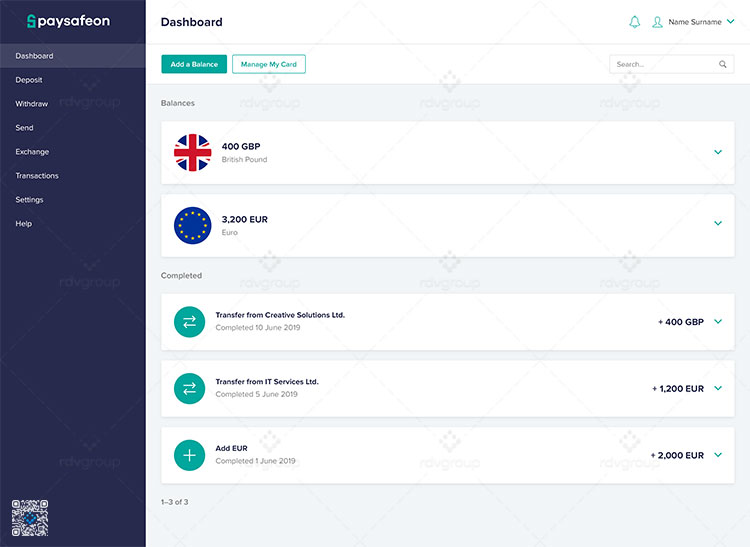

Each project role has its own access implementation:

- Administrator – Access to all configurations of the system

- Operator – Access to limited data necessary for full work performance

- Client – Access to the web interface (Desktop or Mobile version), where option presence depended on the type of account (Private, Business or Merchant) and activity

To ensure the work of functional requirements, the following solutions were implemented:

- Business process modelling and future client support configuration

- Deployment of process control systems

- Server infrastructure adhering to all data and data processing protection standards

- Integration with bank and payment systems ( Examples: Skrill, Neteller, Raiffeisen Bank)

- Merchant API which allows carrying out integration on merchant resources and payment for goods/services

- Back office for configuration and development of system modules, for example:

- Multi-currency accounting

- Business logic configuration

- Payment and document processing

- Deposits:

- Deposit product configuration

- Deposit interest calculation schemes

- Deposit agreement registration

- Deposit agreement management

- Deposit closing

- Application to open a deposit in the web-bank

- Sign of an account being a deposit account + display of account for interest accrual in the web-bank

- Currency exchange

- Reporting

- Administration

- Rates and commissions

- Correspondent banks

- Module for cryptocurrency operations control (Selling, purchase, input, output)

- Module for IBAN account integration

- Module for providing transaction functionality in the system (rates, commissions, currency exchange etc)

- Module for risk control and declared standard adherence monitoring (KYC, AML, etc)

- Module for client notification and contact (SMS, Email)

Technologies

- PHP/Yii framework, .NET, NodeJs

- MS SQL, MySQL

- Windows Server 2016, Linux server

- Power BI, Gitlab, Zabbix, pfsense

- RDP, VPN

- Atlassian JIRA, Confluence

Services

IT outsourcing with dedicated resources for a large business

- Project management

- Software development and management

- Development and expansion strategy

- Infrastructure security

- Audit

- Corporate design

- Individual solution